DMS systems like CDK and Reynolds & Reynolds feel more like digital fortresses than platforms. They are closed off, bloated, and built for a different era, before APIs, before real-time data sharing, and before customers expected to buy a car as easily as they order a coffee.

Reynolds & Reynolds has its Reynolds Certified Interface (RCI) program, which is the only official path for third-party vendors to access their system data. This program requires certification, audits, and ongoing fees that are often prohibitive for smaller vendors. As of recent estimates, vendor directories such as the Gillrie Institute report over 120 approved RCI partners. This is a relatively small number given the size of the market.

CDK powers a large portion of the dealership market and offers data access through legacy tools like SOAP APIs and SFTP workflows (CDK Data Your Way). While this enables some level of integration, it still means scheduled exports, manual setup, and working with a flattened, often over-bloated data structure that demands specialized technical resources.

When Legacy Tech Was Hit Hard — CDK's Ransomware Crisis

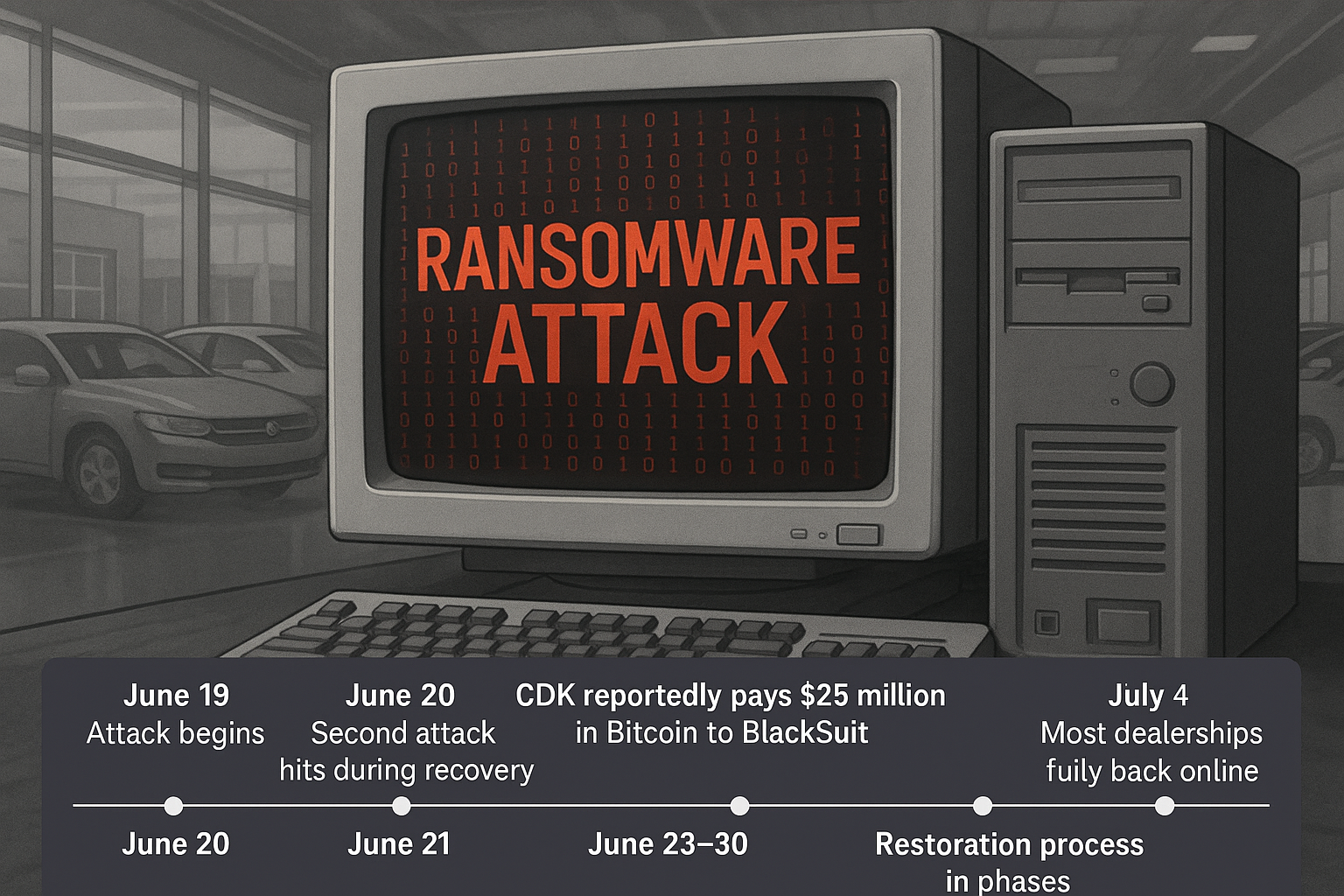

In June 2024, CDK Global was struck by a ransomware attack carried out by the BlackSuit group, forcing it to shut down most of its IT systems to contain the breach. The attack disrupted approximately 15,000 dealerships across North America (Wikipedia, Centraleyes).

A second cyberattack hit during the recovery process, forcing CDK to shut down again. Many dealerships reverted to manual, pen-and-paper operations for over a week (Reuters). The industry impact was massive, with sales delays and operational slowdowns costing an estimated $600 million during the two-week outage (Ars Technica).

AutoNation reported that the outage would likely reduce its second-quarter earnings per share by about $1.50, cutting projections from around $4.50 to the $3.15–$3.30 range (Reuters). JD Power estimated that U.S. retail unit sales in June 2024 fell by up to 7% compared to the prior year, partly due to the disruption (Wikipedia).

This event underscored the operational risk of relying entirely on a single, closed vendor for mission-critical dealership systems.

The Middle Layer Attempts

Over the years, companies have tried to create middle layers to make data sharing between dealerships and vendors more seamless. DealerVault by Authenticom is one example. They built a platform with a clean portal and organized communication for dealers and vendors (DealerVault).

The challenge is not their execution but the fact that DMS systems are mostly closed. For example, when integrating with Reynolds & Reynolds, DealerVault installs a desktop application at the dealership that checks a local folder for manually generated reports. If dealership staff don't run those reports regularly, the data feed stalls. Even with full compliance, the limitations are dictated by the DMS, not the middle layer's intent or design.

Closed, Over-Bloated Systems Hurt Entire Industries

Closed systems are not unique to automotive. The same pattern has appeared in other industries. In HR and finance, PeopleSoft was once the standard. It was powerful, but also over-bloated, heavily customized, and expensive to maintain. Integrations were painful, upgrades were slow, and companies often found themselves stuck years behind modern functionality.

Then came Workday. Founded by former PeopleSoft executives, Workday was cloud-native, API-driven, and continuously updated. Over time, many organizations that once ran PeopleSoft shifted to Workday to gain agility, lower costs, and the ability to keep up with modern expectations.

The parallel in automotive is clear. Reynolds & Reynolds and CDK represent the closed, legacy model that is costly to integrate, slow to innovate, and resistant to change. Middle-layer solutions like DealerVault have tried to bridge the gap, but they can only do so much when the foundation is locked down.

In every industry, closed and over-bloated systems eventually hurt the very businesses they were designed to serve. They stifle innovation, increase risk, and leave customers frustrated. Automotive is no different. The longer dealerships remain tied to outdated DMS systems, the further behind they will fall compared to industries that embraced open, connected platforms.

Why This Matters

Consumers can order coffee, file an insurance claim, or buy groceries online with near-zero friction. Buying a car should be just as simple. Financing, paperwork, and after-sale tasks should be connected into one seamless, trackable journey.

The roadblock is not dealerships unwillingness to modernize. It is that legacy DMS platforms remain closed, slow to evolve, and resistant to modern cloud-based integration that would allow third-party systems to connect securely through modern standards.

The Vision OmnitrixHub Amplifies

Customers expect every dealership interaction, from buying a car to scheduling service, to feel as seamless as ordering a coffee on their phone. But with today's closed DMS systems, reaching that goal is almost impossible.

At OmnitrixHub, we believe dealerships should not be chained by outdated technology. Workflows should be transparent, automated where possible, and integrated in real time. Our platform helps dealership groups move closer to this vision by creating the operational clarity, automation, and visibility that legacy platforms simply do not provide.

We do not replace the DMS. We work alongside it, creating an operational layer that standardizes workflows, improves visibility, and connects teams across departments. This frees staff from repetitive manual tasks, gives customers a smoother buying experience, and gives leadership the oversight they need.

A Nod to Tekion and the Future

Modern, API-first platforms like Tekion are already showing what's possible when technology is designed for today's expectations. Dealerships that adopt open, connected systems will pull ahead, while those that cling to closed, outdated models will find it harder to compete.

Market Outlook — The Shift Is Coming

Dealerships are still profitable under the current model, which reinforces the “if it isn't broken, why fix it” mindset. But the market will not stay static. The next generation of car buyers grew up with Amazon, on-demand ordering, real-time tracking, and post-COVID digital-first retail. They expect buying a car to match those experiences.

Over time, competitive pressure and consumer demand will push the industry toward open, integrated, customer-friendly systems. The change will be slow at first, then accelerate. OmnitrixHub is built for that future, helping dealerships evolve without scrapping existing systems and giving them the operational clarity and agility needed to thrive in a changing market.

Final Word

Automotive retail is at its PeopleSoft moment. The legacy systems that once defined the industry are now holding it back: closed, over-bloated, and resistant to change. Just as Workday redefined how enterprises manage HR and finance, dealerships will need an operational layer that brings clarity, automation, and openness to their workflows. OmnitrixHub is built to be that bridge. The question is not if the industry will move on from outdated systems, but when. The groups that act first will set the standard for the next era of automotive retail.